Understanding the European Channel: The Path to Growth

Insights from regional channel leaders for Cybersecurity vendors

For a Cybersecurity vendor, a strong indirect sales strategy can be the difference between success and failure. In my latest article, I explored the topic of Strategic Partnerships, as I see that many startups and scaleups in the European Union struggle in developing alliances that will support their growth.

Understanding and leveraging channel partnerships is crucial for cybersecurity vendors aiming to expand their footprint in Europe, but as this is perceived as requiring more time and effort than other sales channels, vendors not always consider them when they launch their products and services to the market for the first time.

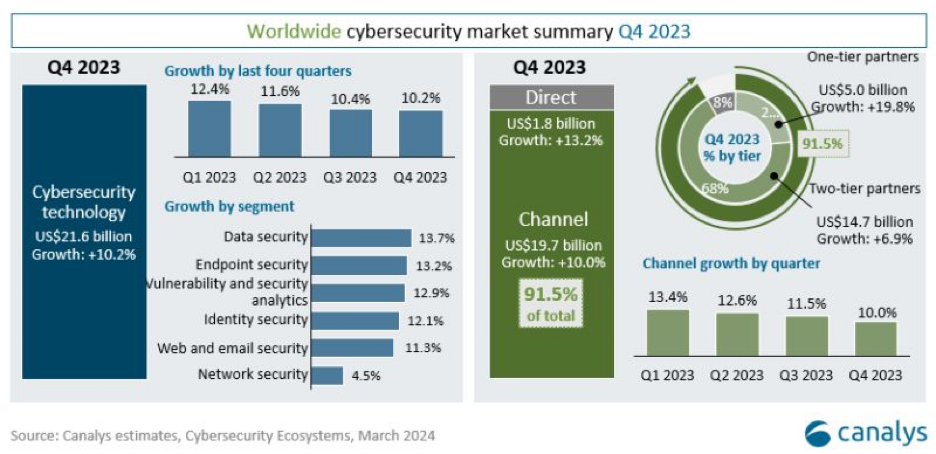

However, as Canalys recently reported, channel partners drive 92 % of the cybersecurity spend, meaning that if you don’t work with them and through them, you are only addressing 8 % of the market.

In my opinion and experience, if any vendor wants to be successful in their market, they need to start to develop partnerships as soon as possible. Companies like Veeam and ESET have become global leaders within their categories thanks to having a strong global network of channel partners.

There are two key reasons why the channel can accelerate the growth of a vendor:

It allows the vendor to scale their global presence, and increase their market reach and access, before even investing in offices and local resources around the world

The channel has the attention and trust from the end customers, talks to them and influences them more often than any particular vendor, because they already have a established relationship with them

Understanding the channel determines the success (or failure) of a Cybersecurity company. That’s why I interviewed channel leaders from Spain, France, Italy and Germany, and below, I am sharing their insights on highly relevant topics that are crucial for the European vendors.

Key Criteria for Channel Partners When Selecting Vendors

When selecting new potential vendors to work with, the channel prioritises innovation, market needs and solution differentiation. As the security leader of one of the "Big 4" said:

“We mainly look into the differentiation the vendor can bring over other existing solutions in the market. The usage of new technologies (like GenAI or Quantum) as well as innovative approaches to known problems are core decision factors for us”

Moreover, the support the vendor can provide, their focus on the channel and the profit partners can generate are also key factors.

Katia Rovezzi, Key Account Manager and Head of Inside Sales at ICOS s.p.a. (Italy) mentioned the current market trends and needs play a key factor in their selection process, a common answer among all interviewees.

“Fundamental elements for the choice are a 100 % channel approach from the vendors and the presence of their reference people in our country”, she added.

The importance of a vendor’s local process was also brought up by other channel leaders, like Mathias Schick, from Bechtle (Germany), who mentioned that another very important topic was the overall competitive landscape.

“Is there room for this vendor in our portfolio, both customer and technology-wise?” is a questions they pose when considering new partnerships.

When a Cybersecurity vendor is working on a strategy to recruit new channel partners, while their technological approach and product quality is important, there is a lot more to take into account as we can see from the answers above.

The Channel’s Continuous Search for Innovation

This might be a surprise for many, but the channel is always looking for and open to new opportunities. In conversations I had with Cybersecurity vendors, many of their sales leaders expected the partners’ approach to be rigid and difficult to change; however, the reality is far from that.

All the interviewees mentioned that they are considering new vendors regularly, as the market is constantly evolving, and the customer needs are currently changing very often due to internal and external conditions.

“We have a scouting process that is always on, with a team of pre-sales engineers constantly monitoring the market in order to identify new vendors that could better fit with our portfolio and strategies”, said Anna Cerimele, from Bludis (Italy), supporting the above.

The changes in the market can be driven as well by regulations and compliance, which motivate the channel to not only look for new solutions, but also to review their whole portfolio. Katia mentioned that at the moment, "ICOS is focusing on vendors that can comply with NIS2 and DORA regulations”, for instance, in many categories.

Another strong reason for channel leaders to consider new vendors to work with are their customers requests. Alexandra Nina Lichtfuß from CyProtect AG (Germany) and Mathias Schick, among others, were two of the respondents that mentioned that customers requesting a particular new type of solution or mentioning a specific vendors can be even more relevant than anything else.

Lastly, the channel is also affected by their relationships with the vendors that are currently part of their portfolios, something that can change or deteriorate over time, forcing them to look for new partnerships, as we have seen recently happening due to recent the acquisition of VMWare by Broadcom.

The Relevance of Regional Vendors on the European Channel strategies

One would think that in the current market landscape and geopolitical situation, vendors based in the European Union would have some advantages in the consideration of the regional channel. However, the relevance of this varies substantially among the respondents.

All the channel leaders that I consulted for this article have vendors from all over the world in their portfolio, which makes sense in an industry like Cybersecurity where the majority of the leaders are from the United States.

“Some customers value European vendors, in particular those looking for on-prem solutions, yet as Microsoft is dominant everywhere, as well as Google, AWS, or IBM in the cloud and datacenter space, this creates peculiar situations and discussions with our clients”, mentioned Alexandra from CyProtect.

The Public Sector seems to have a preference for European vendors according to many of the interviewed channel leaders. Katia mentioned that this type of organizations “prefer European vendors while it is more difficult to propose Chinese technologies to them” and Mathias and her agreed on the connection this has to the topic of digital sovereignty and the physical location where the data is stored.

A french channel leader went into more details: “We have four vendors within one category in our portfolio, with only one of them from the EU. The main reason for having them is to have an option available for government agencies and local companies that require European vendors.”

Logically, when asked if labels like Cybersecurity Made in Europe or partnerships with European Union organizations played a relevant role in the decision making process for selecting vendors to work with, the interviewees tended to minimise their value.

Those that did give importance to the above labels and partnerships mentioned them only in those situations when specific customers could consider them a knock off criteria or an additional value.

Looking into the future, some of them highlighted that some of the new regulations, like the European Union Cybersecurity Certification could lead to having to choose from vendors holding it for some of their customers.

Future Prospects for European Vendors

When consulted about what are the areas where they see more opportunities for European vendors, there's a consensus that the opportunities do not lie in a specific market area but rather in solutions addressing local regulatory requirements and data protection and sovereignty.

“Being European is important, but more from a business point of view. To deal with a company that knows our market and its rules can facilitate the work of the distributor”, added Anna on this topic.

However, her opinion wasn’t the norm among those consulted. “I believe that the opportunities are mainly connected to the ability of vendors on bringing innovative solutions to the market, as well as those that improve the efficiency of the security operations”, mentioned one of them.

This focus on innovation was mentioned by several others, like Mathias, who would welcome to see “more progressive ‘Next-Gen Security’ vendors besides the established ones in categories like Endpoint Security and XDR”.

European vendors, in the view of the regional channel, need then to focus on innovation and on capitalising on the opportunity to develop business relationships based on a common understanding of the market.

Considering that for many of the channel leaders is important to have vendors close to them, this could be the most important edge ahead for the local cybersecurity companies.

Understanding the Channel is the Key to Success

If a Cybersecurity vendor aims to be successful in the European Union, they need to work with regional partners sooner rather than later.

While the above has been collected from a small group of channel leaders across the region, it shows how relevant is to prioritise the development of robust channel partnerships. Vendors need to be always recruiting and communicating with their partners, considering their insights, and taking advantage of the opportunities that appear as the market evolve.

Innovation and differentiation are important, but also the evolving needs driven by the regulatory landscape and the closeness to the channel. Moreover, Cybersecurity companies need to work on generating demand from end customers to raise the attention of the channel on their solutions.

With the insights shared by the interviewed channel leaders, vendors can develop a roadmap to navigate the complexities of the European Cybersecurity channel. The journey ahead requires a combination of strategic vision, innovative thinking and a deep commitment to nurturing partnerships that can thrive in the ever-changing cybersecurity ecosystem.

Thanks for sharing. The channel has the same value in tech overall, there's a little less dependency around it. For European cybersecurity companies, the channel also represents easier access to the US market, which is defining for cybersecurity.